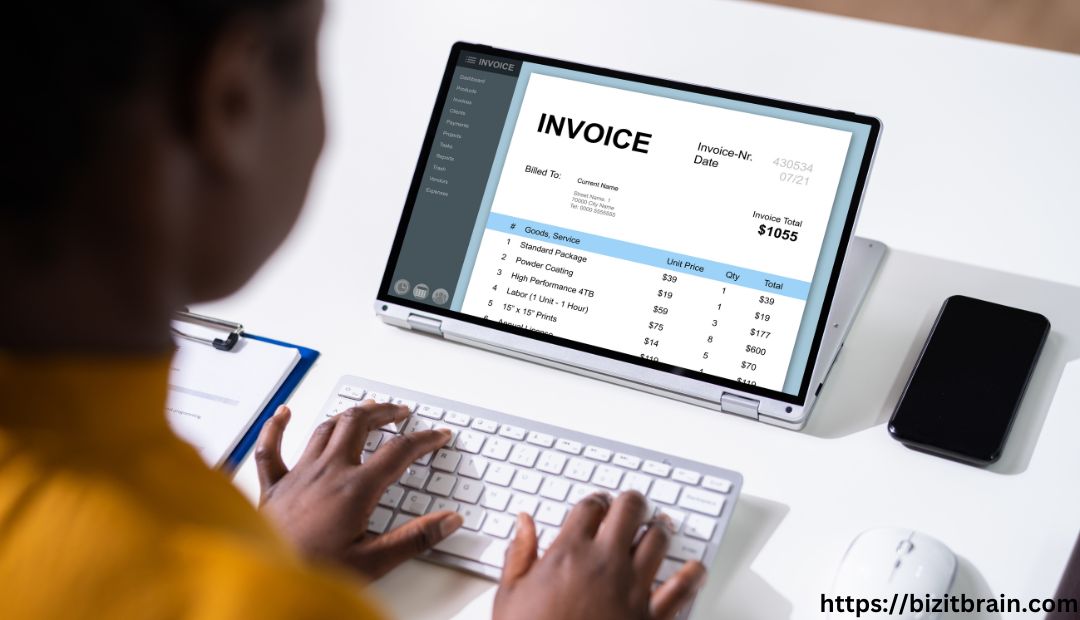

In the world of business, organization and clarity are key to smooth operations. One crucial aspect that often gets overlooked is the reference invoice. This simple yet powerful tool can streamline billing processes, enhance communication with clients, and ultimately drive timely payments. Whether you’re a freelancer or managing a large corporation, understanding the importance of a reference invoice can transform how you handle your financial transactions. Let’s dive into what makes it indispensable for effective invoicing practices!

The Importance of Reference Invoice

A reference invoice serves as a key identifier for transactions, ensuring clarity and reducing confusion when managing payments. It allows businesses to track invoices easily and helps clients locate specific documents in their records.

By incorporating reference invoices, companies can enhance their financial organization and improve communication with clients. This leads to quicker resolution of payment disputes and fosters trust between parties involved. The importance of this tool cannot be overstated, especially for those looking to optimize their invoicing processes efficiently.

Invoice Reference Definition

An invoice reference is a unique identifier assigned to each invoice. This number enables both the sender and recipient to track transactions efficiently. It simplifies communication regarding payments, disputes, or inquiries.

In essence, an invoice reference acts like a fingerprint for billing documents. By using this specific identifier, businesses can streamline their accounting processes and ensure accuracy in financial record-keeping.

Examples of Invoice Reference in a Sentence

A reference invoice can streamline your billing process. For example, “Please refer to the reference invoice #12345 for details regarding our recent transaction.” This helps both parties quickly locate relevant information.

Another instance could be, “The payment was made against the reference invoice dated March 10.” Such sentences clarify which specific invoice is being discussed and enhance communication accuracy between businesses and clients.

Benefits of Using Invoice References

Using reference invoices simplifies tracking and organization. Each invoice is uniquely identified, making it easier to manage payments and resolve discrepancies quickly. This clarity reduces confusion for both businesses and clients.

Additionally, reference invoices enhance communication during transactions. Customers can easily refer back to specific documents when discussing payments or services rendered. This fosters a professional relationship built on transparency and trust, ultimately improving customer satisfaction while streamlining financial processes.

Quotation Format

A quotation format serves as a structured way to present pricing information. It typically includes essential details like the company name, contact info, and itemized services or products with their corresponding prices.

Using a clear layout can enhance professionalism. Providing terms and conditions is also vital, ensuring both parties understand the agreement. This clarity helps in minimizing disputes and streamlining communication throughout the transaction process.

Refrens Invoice

A Refrens invoice simplifies the billing process for freelancers and small businesses.This tool stands out by allowing users to customize their invoices with branding elements, ensuring a professional appearance.

Using Refrens also streamlines payment collection. Clients receive an organized view of outstanding bills and due dates, making it easier for them to settle payments promptly. With features like automatic reminders, both parties benefit from improved communication throughout the invoicing cycle.

Reference Invoice

A reference invoice is an essential tool in financial transactions, serving as a unique identifier for billing purposes. It helps both buyers and sellers track payments, ensuring clarity and accountability throughout the invoicing process.

By incorporating a reference number on invoices, businesses can streamline their accounting efforts. This practice simplifies record-keeping and enhances communication between parties, reducing misunderstandings about payment statuses. Efficient management of these references fosters smoother business operations and strengthens client relationships over time.

Refrens Login

Logging into Refrens is a straightforward process designed for ease of access. Users simply enter their credentials on the login page to manage invoices, track payments, and handle client communications efficiently.

It ensures that managing your invoicing needs is just a few clicks away, making it an essential tool for freelancers and small businesses alike.

How to Create and Manage Invoice References

Creating and managing invoice references is essential for efficient billing. Start by establishing a clear format that includes key identifiers like client names, dates, and unique reference numbers. This structure ensures each invoice can be quickly tracked and retrieved.

Next, regularly update your reference system as invoices are issued or settled. Utilize software tools to automate this process whenever possible. Keeping everything organized not only streamlines operations but also enhances transparency in financial transactions, making it easier for both you and your clients to manage payments effectively.

Invoice References in Billing Applications

Invoice references play a crucial role in billing applications. They serve as unique identifiers for each transaction, making it easier to track payments and manage financial records. By integrating invoice references into your system, you enhance clarity and reduce the chances of errors.

Moreover, many billing applications allow users to search by reference numbers quickly. This feature significantly streamlines the process of locating specific invoices. As a result, businesses can maintain organized records while improving their overall efficiency in managing transactions.

Managing Invoice References in Subscription Billing

Managing invoice references in subscription billing streamlines the payment process for recurring customers. Each reference acts as a unique identifier, making it easy to track payments and manage accounts effectively.

By linking invoices to specific subscriptions, businesses can avoid confusion and ensure accurate record-keeping. This organization helps prevent errors while providing clients with clear documentation of their transactions, enhancing customer satisfaction.

Enabling Invoicing

Enabling invoicing is a crucial step for any business that wants to maintain accurate financial records. By implementing an effective invoicing system, you ensure that all transactions are documented and easily tracked.

you’re using software or manual methods, enabling invoicing allows you to generate invoices efficiently and keeps your finances organized. This creates transparency with clients and boosts overall professionalism in your operations.

Managing Invoice States

Each state—draft, sent, paid, or overdue—provides essential insights into your cash flow and customer interactions. By keeping track of these statuses, businesses can ensure timely follow-ups and avoid potential payment delays.

Additionally, understanding the various states helps in identifying trends in client behavior. This knowledge allows companies to refine their invoicing process further, improving overall efficiency. Staying organized with invoice states builds trust with clients while streamlining the billing workflow effectively.

Viewing, Editing, and Deleting Invoices

Viewing invoices is essential for keeping track of your financial transactions. Most billing applications offer a user-friendly interface that lets you easily access all your issued invoices. You can quickly check details such as amounts, dates, and services provided.

Editing invoices may be necessary if errors occur or adjustments need to be made. Many platforms allow users to edit key information seamlessly. Deleting an invoice is also possible when it’s no longer relevant or was created in error, ensuring that your records remain accurate and up-to-date without cluttering the system.

The Role of Invoice References in Improving Payment Processes

Effective payment processes are crucial for any business. Invoice references play a significant role by providing clarity and organization in billing practices. When clients receive an invoice with a clear reference, they can quickly identify the purpose of the charge. This reduces confusion and minimizes disputes.

Furthermore, having consistent invoice references helps businesses track payments more efficiently. It enables better communication between parties involved, fostering trust and reliability. By streamlining these processes, companies can enhance cash flow management while improving customer satisfaction.

Incorporating reference invoices into your operations not only simplifies transactions but also builds a solid foundation for financial success. Embracing this practice is essential for any organization aiming to optimize its invoicing strategy.